The /payment_bank API calls

The payment_bank object represents a bank account that is tokenized from the tokenization.3.latest.js library and is used for payments.

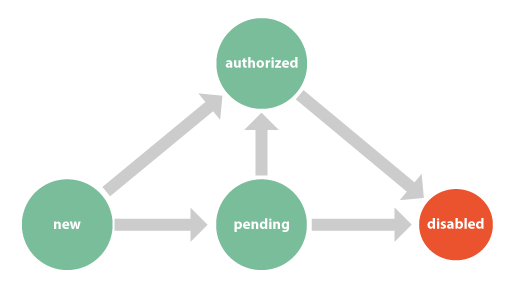

Payment Bank States

The payment_bank object has the following states and possible state transitions:

| new | The payment bank was just created by the application. |

| pending | The payment bank is being authorized for use with a checkout. If a user goes through the manual account entry flow during tokenization, we send deposits to their account and ask them to confirm them. |

| authorized | The payment bank is authorized for use with a checkout. |

| disabled | The payment bank has been disabled. |

Version: v2 2019-04-03

POST Endpoints

/payment_bank

https://wepayapi.com/v2/payment_bank

/payment_bank/persist

https://wepayapi.com/v2/payment_bank/persist

/payment_bank/verify

https://wepayapi.com/v2/payment_bank/verify

/payment_bank

Use this call to look up the details of a payment bank.

Arguments

| Parameter | Required | Type | Description |

| payment_bank_id | Yes | Integer (64 bits) | The unique ID for the payment bank you want to look up. |

| client_id | Yes | Integer (64 bits) | The ID for your API application. You can find it on your application's dashboard. |

| client_secret | Yes | String (255 chars) | The secret for your API application. You can find it on your application's dashboard. |

Example

{

"payment_bank_id": 235810395803,

"client_id": 12345,

"client_secret": "asbasf2341"

}

Response

| Response | Type | Description |

| payment_bank_id | Integer (64 bits) | The unique ID for the payment bank. |

| bank_name | String (255 chars) | The name of the payment bank account. |

| account_last_four | String (255 chars) | The last four digits of the payment bank account. |

| state | String (255 chars) | State of the payment bank. |

Example

{

"payment_bank_id": 235810395803,

"bank_name": "My Bank Name",

"account_last_four": "9876",

"state": "new"

}

/payment_bank/persist

Use this call when you want to save a bank account on your platform for later use as a payment method, without calling /checkout/create now. If the payer has already verified the bank account, it will be available immediately for use as a payment method. If the payer has not verified the bank account, this call will initiate the sending of micro-deposits.

Arguments

| Parameter | Required | Type | Description |

| payment_bank_id | Yes | Integer (64 bits) | The unique ID of the payment bank. |

| client_id | Yes | Integer (64 bits) | The ID for your API application. You can find it on your application's dashboard. |

| client_secret | Yes | String (255 chars) | The secret for your API application. You can find it on your application's dashboard. |

Example

{

"payment_bank_id": 235810395803,

"client_id": 12345,

"client_secret": "asbasf2341"

}

Response

| Response | Type | Description |

| payment_bank_id | Integer (64 bits) | The unique ID for the payment bank. |

| bank_name | String (255 chars) | The name of the payment bank account. |

| account_last_four | String (255 chars) | The last four digits of the payment bank account. |

| state | String (255 chars) | State of the payment bank. |

Example

{

"payment_bank_id": 235810395803,

"bank_name": "My Bank Name",

"account_last_four": "9876",

"state": "authorized"

}

/payment_bank/verify

Using WePay’s notification APIs, your platform receives a webhook when a payer initiates the micro-deposit verification flow. Once the two micro-deposits are deposited in the payer’s bank account and the payer is ready to verify the microdeposit values, your platform can use the /payment_bank/verify call to collect the micro-deposit amounts and pass the values to WePay for verification.

In concert with the notification APIs, the /payment_bank/verify call allows your platform to retain full control of the user experience surrounding the micro-deposit verification process.

Arguments

| Parameter | Required | Type | Description |

| client_id | Yes | Integer (64 bits) | The ID for your API application. You can find it on your application's dashboard. |

| payment_bank_id | Yes | Integer (64 bits) | The unique ID of the payment_bank. |

| client_secret | Yes | String (255 chars) | The secret for your API application. You can find it on your application's dashboard. |

| type | Yes | Constant | microdeposits |

| microdeposits | Yes | Integer | The list of micro-deposits recieved by the account. Order doesn't matter. Units are in the base currency of the account (e.g. pennies for U.S. accounts). |

Example

{

"client_id": 1234,

"client_secret": "b1fc2f68-4d1f-4a",

"payment_bank_id": 12345,

"type": "microdeposits",

"microdeposits": [

8,

12

]

}

Response

| Response | Type | Description |

| payment_bank_id | Integer (64 bits) | The unique ID for the payment bank. |

| bank_name | String (255 chars) | The name of the payment bank account. |

| account_last_four | String (255 chars) | The last four digits of the payment bank account. |

| state | String (255 chars) | State of the payment bank. Possible values: new, pending, authorized, disabled. |

Example

{

"payment_bank_id": 12345,

"bank_name": "Wells Fargo",

"account_last_four": "6789",

"state": "authorized"

}